|

||

|

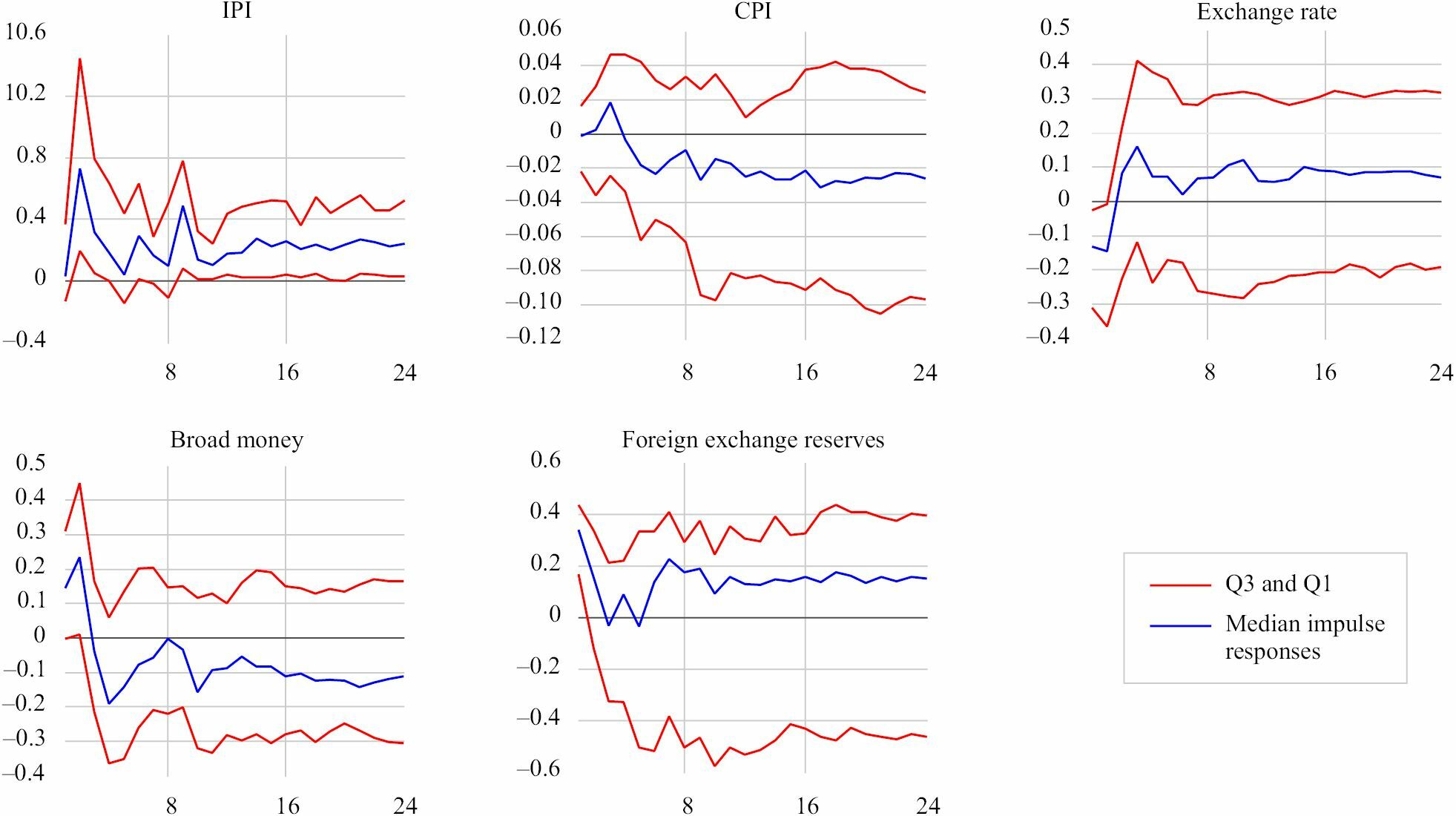

Impulse response functions to shock in US effective federal fund rate. Note: The figure depicts the IRFs to a one-standard deviation shock in the effective FFR of the US for a monthly dataset on 29 emerging markets. The identification of unanticipated shocks in US FFR is done in the US SVAR model. The point-wise median responses represent the percentage responses of IPI, CPI, exchange rate, broad money, and foreign exchange reserves of EMEs due to a positive shock in the US FFR over time. Source: Compiled by the author. |